Intellego Technologies AB ($INT): The Anatomy of a Compelling Short - Unmasking Financial Fragility and Deceptive Practices

Company: Intellego Technologies AB (publ)

Stock Exchange: Nasdaq First North Growth Market

Ticker: INTELL B

Company: Intellego Technologies AB (publ) Stock Exchange: Nasdaq First North Growth Market Ticker: INTELL B

Our Goal: Pulling Back the Curtain on Intellego

Our objective is simple: to pull back the curtain on Intellego Technologies (INTELL B). We believe the company is riddled with financial vulnerabilities and is actively misleading investors. This isn't just a hunch; we're building the case for a short-sell, grounded in a wild valuation, questionable accounting, a troubling history with regulators, and a corporate story that seems designed to hide the truth.

Our Stance: A High-Conviction Short.

On the surface, Intellego Technologies (INTELL B) looks like a success story. The company, which sells UV indicators, has pitched a story of explosive growth to the market. But when you dig into their financials and regulatory filings, that story falls apart. We've found a deeply troubling picture that points directly to one conclusion: this stock is a high-conviction short. The market has yet to fully grasp how precarious Intellego's situation is; this report aims to fix that.

I. Executive Summary: The Compelling Case for Shorting Intellego Technologies AB (INTELL B)

Intellego Technologies AB (publ) ("Intellego" or "the Company"), a purveyor of colorimetric ultraviolet (UV) indicators listed on the Nasdaq First North Growth Market (INTELL B), has presented a narrative of explosive growth and technological prowess. However, a forensic examination of its financial statements, regulatory history, and corporate disclosures uncovers a deeply troubling picture, strongly supporting a high-conviction short thesis.

Core Tenets of the Short Thesis:

The Accounts Receivable Deception – A Ticking Time Bomb: A focal point of our concern is the alarming and unsustainable surge in Intellego’s accounts receivable, which skyrocketed by 104% to 188 million SEK in 2024. This explosion in yet-to-be-collected revenue, ostensibly facilitated by a credit facility from Nordea/EKN, is not a sign of robust health but rather a glaring indicator of potentially dubious sales quality, aggressive revenue recognition, or an inability to convert sales into cash. The company’s provision of ~17 million SEK for doubtful receivables barely scratches the surface of the inherent risk. We question whether this credit line is enabling Intellego to offer untenably generous payment terms to achieve illusory growth, effectively financing its own sales at the risk of massive future write-offs. This practice is symptomatic of companies masking poor cash conversion and operational deficiencies.

Dubious Accounting Practices & Inflated Performance (H1): Beyond the receivables crisis, Intellego's financials are marred by further accounting irregularities. A significant Q1 2025 Capital Expenditure of 42,974 TSEK, coinciding with a 29,055 TSEK inventory reduction, strongly suggests a potential misclassification of operational costs (inventory) as capital investments. Such maneuvers would serve to artificially inflate critical metrics like Operating Cash Flow and gross assets, presenting a distorted image of financial strength. Furthermore, the convoluted and delayed accounting for the Daro Group acquisition, which even the company's auditor, Deloitte, acknowledged "deviated from standard procedure," reeks of attempts to manipulate financial presentation during a critical period. A detailed examination of IFRS compliance, particularly concerning IAS 2, IAS 16, and IFRS 15 in relation to the company's "razor-razorblade" Yuvio model, as detailed in Table 2 of this report, reveals further extensive cause for alarm.

Systemic Regulatory Non-Compliance & Misleading Disclosures (H2): Intellego is not merely a company that has made isolated missteps; it is a serial offender in the eyes of its primary market regulator. The Nasdaq Disciplinary Committee’s imposition of a significant fine (equivalent to twelve annual fees, ~2.2M SEK) in August 2024 for repeated and serious breaches of Market Abuse Regulation (MAR) and the Nasdaq First North Rulebook underscores a profound lack of respect for market integrity or a fundamental incapacity for compliant operations. These violations, meticulously cataloged in Table 3, including late disclosure of the Daro acquisition, misleading financial reporting, and misidentification of a key counterparty in a major order announcement (the RCS/RCSI/GDPL debacle), demonstrate a pattern of behavior designed to potentially mislead investors and artificially support its stock valuation.

Questionable Executive Conduct & Governance Deficiencies (H3): While direct evidence of illicit securities lending by CEO Claes Lindahl remains elusive, his pattern of significant share purchases, particularly timed around key announcements and periods of intense scrutiny (also detailed in Table 3), invites critical questions. Are these genuine expressions of confidence, or calculated moves to manage market perception in the face of undisclosed internal turmoil or impending negative revelations? The involvement of opaque entities like Eden Funds and Curam Holding AB in directed share issues, ostensibly to meet partner "requirements," further clouds the governance picture and raises concerns about potential conflicts of interest. The notable turnover in key board and management positions during critical junctures, outlined in Table 4, adds another layer of profound concern regarding the stability and integrity of Intellego's leadership.

Valuation Implications & Impending Negative Catalysts:

The confluence of these factors points to a company whose market valuation is built on a foundation of sand. The probability of some form of securities fraud, sustained accounting manipulation, or significant executive misconduct is, in our assessment, alarmingly High.

Investors should be prepared for a cascade of negative catalysts:

Regulatory Escalation: Further investigations by Finansinspektionen or Nasdaq, potentially leading to more severe sanctions or forced restatements, could shatter investor confidence. Specific probes into the accounting treatments highlighted in this report are urgently needed.

Receivables Implosion: A failure to collect on the mountain of outstanding receivables, leading to substantial write-offs, would directly expose the hollowness of past revenue growth. Any tightening or withdrawal of the Nordea/EKN credit facility could precipitate a liquidity crisis.

Auditor Scrutiny: Increased auditor scrutiny or, in a more severe scenario, a qualified opinion or resignation from Deloitte, would be a devastating blow.

Market Realization: As the true extent of Intellego's financial fragility and governance failings becomes more widely understood, a significant and painful re-rating of its stock is not merely possible, but probable. The inevitable legal fallout, including potential civil litigation from aggrieved investors, will further tarnish the company's reputation.

This report lays bare the evidence. Intellego Technologies AB is, in our considered view, a fundamentally flawed enterprise whose stock price is poised for a significant decline as the market grapples with the realities outlined herein.

II. Detailed Findings & Evidence Matrix: Deconstructing the Intellego Facade

This section presents the detailed evidence underpinning our short thesis, systematically exposing the operational, financial, and governance deficiencies that render Intellego Technologies AB a prime short candidate.

A. H1: The Engine of Deception – Accounting Fraud & Revenue Recognition Manipulation

Intellego’s financial reporting appears to be a masterclass in aggressive accounting, designed to project an image of robust growth and profitability that is likely divorced from economic reality. Our investigation uncovers critical vulnerabilities in how the company recognizes revenue, classifies expenditures, and accounts for significant acquisitions – all pointing towards a systematic overstatement of performance.

1. The Accounts Receivable Crisis: Financed Growth or a Ticking Time Bomb?

The most glaring symptom of Intellego's financial malaise is the explosive 104% growth in trade receivables, ballooning to an unsustainable 188 million SEK in 2024.[10] This figure, representing a substantial portion of reported annual revenues, is a monumental red flag. While management attributes this to a strategy of offering extended payment terms to fuel market share acquisition [10], we contend this is a dangerous game that masks severe underlying problems:

Poor Quality of Sales: Such a dramatic rise in receivables strongly suggests that Intellego is recognizing revenue on sales that are of dubious quality, potentially to customers with weak creditworthiness, or under terms so generous they border on consignment sales. The reported provision of approximately 17 million SEK for doubtful accounts [10] seems wholly inadequate in the face of this receivables mountain.

Cash Flow Deception: Revenue without cash is not true economic gain. The burgeoning receivables balance indicates a severe cash conversion cycle issue. While Intellego has secured a factoring/credit insurance facility with Nordea/EKN (covering 80M TSEK by the 2024 AR date [10]), this is not a panacea. Rather, it may be enabling the company to continue its aggressive sales practices by providing a temporary liquidity bridge. We question the sustainability of this model:

What are the covenants and costs associated with this Nordea/EKN facility?

What happens if this facility is curtailed, or if customer defaults exceed insured limits?

Is Intellego effectively "selling" its future by pulling forward revenues that may never materialize as cash, all while potentially incurring significant financing costs or recourse obligations?

Echoes of "Non-Cash Earnings": This situation directly correlates with external observations of Intellego's "high level of non-cash earnings," a classic warning sign for accounting manipulation.[33]

The reliance on external credit lines to manage such a massive receivables balance is not a sign of strength but of inherent weakness. It indicates that Intellego’s organic cash generation is insufficient to support its reported growth, forcing it to lean on financial engineering that carries substantial risks. Investors must ask: Is Intellego truly growing, or is it merely "booking" sales that it cannot collect in a timely or complete manner, all while its balance sheet risk escalates?

2. The CapEx Charade: Misclassifying Costs to Inflate Operating Cash Flow (Q1 2025 Anomaly)

Intellego's Q1 2025 financial report presented another critical anomaly that demands explanation: a reported "Acquisition of tangible fixed assets" (CapEx) of a staggering 42,974 TSEK, coinciding with an inventory reduction of 29,055 TSEK (Change of stock, products in progress - Income Statement).[8] This exceptionally high CapEx for a single quarter (nearly two-thirds of the entire 2024 CapEx [10]) is highly suspicious, particularly given the company's "razor-razorblade" model for its UV disinfection devices, heavily promoted via its Yuvio arm.

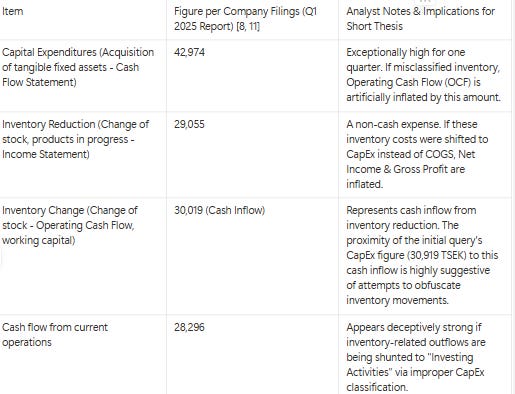

The CEO explicitly stated this CapEx was for "capital equipment" to "enable for Intellego to sell more UV dosimeters over a longer period of time".[5, 6, 8, 9] However, we posit a more troubling interpretation: Intellego may be systematically misclassifying operational costs associated with these UV devices (rightfully inventory under IAS 2) as Capital Expenditures (PPE under IAS 16). The following table starkly illustrates the figures in question:

Table 1: Q1 2025 Financial Anomaly – CapEx vs. Inventory Reconciliation (TSEK)

The implications of such a misclassification, as highlighted in Table 1, are severe:

Artificial Inflation of Operating Cash Flow (OCF): Purchases of inventory are operating cash outflows. Capital expenditures are investing cash outflows. Shifting costs from inventory to CapEx directly and misleadingly inflates OCF.

Distortion of Asset Base & Profitability: This would overstate Property, Plant & Equipment on the balance sheet and potentially understate Cost of Goods Sold (COGS), thereby inflating reported gross and net profits if the costs of devices "sold" or "leased" as sales inducements are not correctly matched against revenue.

The company’s assertion that each product is a separate performance obligation under IFRS 15 [10, 16] does not automatically justify capitalizing devices whose primary purpose is to drive consumable sales, especially if these devices are sold at low margins or effectively given away. This accounting treatment warrants immediate and rigorous investigation by auditors and regulators.

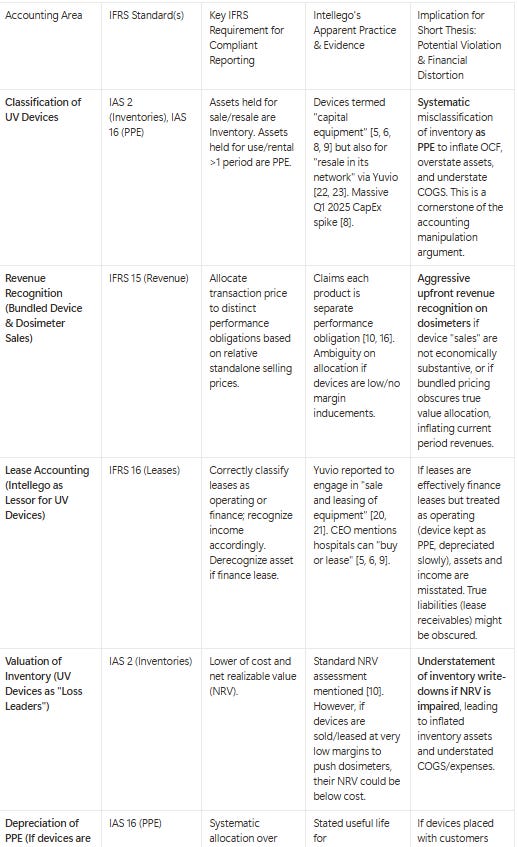

3. Broad IFRS Compliance Deficiencies – A Systemic Issue Unveiled

The potential misclassification of CapEx and inventory is not an isolated concern. A closer examination of Intellego's accounting policies, particularly in relation to its Yuvio "razor-razorblade" model, reveals a minefield of potential IFRS violations, as detailed in Table 2. Each line item in this table points to a specific way Intellego might be bending or breaking established accounting rules to its advantage. For instance, the classification of UV devices as PPE instead of Inventory is fundamental. If these devices are primarily for resale or are short-term inducements for dosimeter sales, IAS 2 clearly dictates inventory treatment. Treating them as long-term PPE under IAS 16, with a 5-7 year depreciation schedule, is unjustifiable if their true economic life in a customer's hands (before an upgrade or replacement to drive more dosimeter sales) is much shorter. This practice alone would systematically understate expenses and overstate profits and assets.

Furthermore, the aggressive revenue recognition (IFRS 15) on bundled deals, especially if the "standalone selling price" of the low-margin device is artificially deflated to pull forward high-margin dosimeter revenue, is a classic red flag. The company claims each product is a separate performance obligation, but the economic substance of these Yuvio model transactions demands intense scrutiny. Are customers truly buying a long-life capital asset, or are they receiving a near-giveaway device in exchange for lucrative, long-term consumable commitments? The accounting must reflect this economic reality, not just the form of the contract.

Table 2: IFRS Compliance – Key Areas of Concern (UV Disinfection Devices & Yuvio Model)

These potential deviations from IFRS are not mere technicalities; they represent mechanisms through which a company can fundamentally misrepresent its financial health and operational success.

4. The Daro Group Quagmire: A Case Study in Obfuscation and Questionable Audit Oversight

The August 2022 acquisition of Daro Group for approximately SEK 81 million [7, 31] was, from its inception, mired in questionable disclosure and accounting practices, for which Nasdaq ultimately sanctioned Intellego.[25, 26]

Delayed Disclosure: Control was taken on June 1, 2022, yet the market was not informed until August 23, 2022 – a blatant violation of MAR.

Piecemeal and Irregular Consolidation: Shockingly, Daro's income statement was consolidated from June 1, 2022, but its balance sheet was not consolidated until Q4 2022, with management citing "inadequate supporting documentation".[25] This is an accounting anomaly of the highest order. How does a company acquire another and integrate its income without a concurrent, verifiable balance sheet for multiple quarters?

Auditor's Concerning Complicity (Deloitte): The company's own auditor, Deloitte, reportedly acknowledged this consolidation "deviated from standard procedure," attempting to rationalize it as giving the "fairest possible picture".[25] Such a statement from a reputable audit firm is deeply troubling. It suggests either a gross lapse in audit judgment or an unacceptable level of deference to management's preferred, albeit non-standard, accounting treatments. This raises serious questions about the auditor's independence and the overall reliability of the audit process at Intellego. If auditors are willing to sign off on "deviations" for material acquisitions, what other questionable practices might they be overlooking? Investors must question whether Deloitte is acting as a true gatekeeper or merely a rubber stamp for management's aggressive interpretations.

Goodwill & Impairment Risk: The substantial goodwill recognized from the Daro acquisition (82,945 TSEK by YE 2024, including UV Light Technology Limited acquisition via Daro [10]) is another area of concern. Given the irregularities surrounding the initial acquisition and consolidation, the basis for this goodwill is suspect. Furthermore, should Daro's actual performance falter or the initial valuation prove overly optimistic, significant impairment charges could materialize, further eroding Intellego's reported equity and earnings. The lack of detailed Purchase Price Allocation (PPA) disclosures in available reports makes external assessment of this risk exceedingly difficult – another example of Intellego’s opacity.

Such irregularities suggest a deliberate attempt to manage the financial presentation of this significant acquisition, potentially to smooth earnings or conceal underlying issues within Daro at the time of acquisition.

5. Revenue Recognition: The Phantom Order and Questionable Intercompany Sales

The integrity of Intellego’s reported revenue is further compromised by incidents such as the "Phantom Order" debacle. Nasdaq sanctioned Intellego for misidentifying the counterparty in a ~60 million SEK order announcement (initially "Radical Clean Solutions" US, later clarified as "Radical Clean Solutions International"/GDPL after the US entity denied involvement).[25, 28, 29] This incident is not merely a clerical error; it strikes at the heart of revenue veracity. If significant orders are announced with such fundamental inaccuracies, how much confidence can investors have in any of the company's reported sales figures, especially given the enormous pressure to meet its hyper-aggressive growth targets (e.g., "over 10 billion in sales in the next 5 years" [5, 6, 9])?

Adding to these concerns, the 2024 Annual Report revealed a dramatic increase in sales of goods/services to group companies, rocketing to 21,442 TSEK in 2024 from a mere 1,904 TSEK in 2023.[10] While intercompany sales are eliminated in consolidation, such a massive surge in internal transactions warrants intense scrutiny. What is the nature and substance of these sales? Are they being used to shift revenues or inventory between entities for window-dressing purposes at the subsidiary level, potentially complicating the true assessment of organic, third-party demand?

The aforementioned explosion in accounts receivable further fuels these concerns. Are multi-year deals with partners like Henkel and Likang, touted with massive potential values [8, 9, 24, 55, 67, 74, 75], being recognized upfront based on loose commitments rather than concrete, collectible sales?

B. H2: A Pattern of Deception – Market Manipulation & Regulatory Contempt

Intellego’s disregard for regulatory norms is not an isolated failing but a deeply ingrained pattern of behavior, as evidenced by the severe and multifaceted sanctions imposed by Nasdaq Stockholm. This history points to a corporate culture that either lacks the competence for, or willfully evades, transparent and compliant market communication, thereby fostering an environment ripe for market manipulation.

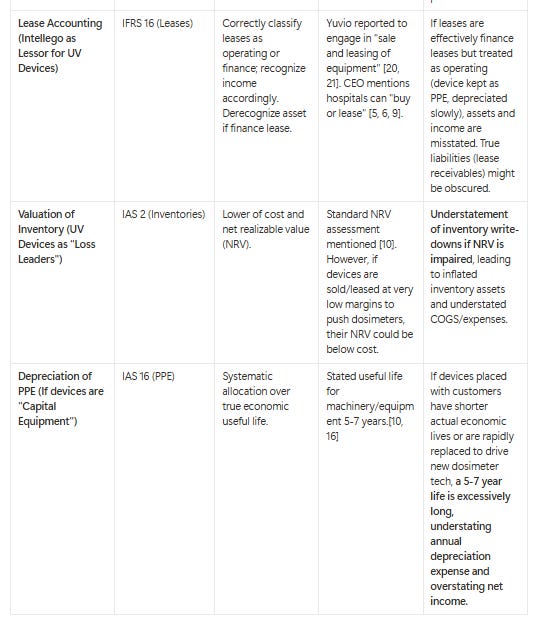

1. Nasdaq’s Damning Verdict: A Litany of Violations (Decision 2024:02)

The Nasdaq Disciplinary Committee’s fine of approximately SEK 2.2 million (a punitive twelve annual fees) on August 19, 2024, was a direct result of Intellego’s repeated and serious breaches of MAR and market rules.[25, 26, 27, 32] The violations, detailed comprehensively in Table 3, are a textbook case of how not to communicate with the market.

Table 3: Timeline of Misleading Disclosures, Regulatory Sanctions, & Key Insider Transactions

The Committee’s explicit finding that these breaches appeared to be "the result of a lack in capacity for providing the market with information"[25, 27] is a severe indictment. Such systemic failures create an opaque market environment, where investors trade on incomplete or misleading information, directly benefiting those with an informational advantage or an agenda to artificially influence the stock price.

2. Insider Transactions: Signaling Confidence or Masking Turmoil?

While a traditional pump-and-dump often involves insider selling at inflated prices, the trading patterns of CEO Claes Lindahl—characterized by significant and strategically timed share purchases as detailed in Table 3—warrant equally critical examination in this context.[34, 35, 36, 37, 38] His substantial acquisition of shares for ~4.0 million SEK on May 28, 2025, immediately following the release of the Q1 2025 results (the very results containing the questionable CapEx figures), is particularly noteworthy.[35, 36]

Were these purchases a genuine signal of robust underlying fundamentals, or a calculated maneuver to project confidence and support the stock price at a time when management was acutely aware of the accounting vulnerabilities and the misleading nature of its reported figures? In a company with such a checkered history of disclosure, one must question the true motivation behind such conspicuous insider buying. This activity, coupled with the sanction against an unnamed individual for late reporting of Intellego share transactions by Finansinspektionen [42, 43, 44], paints a picture of a lax compliance culture surrounding trading in the company's securities.

3. Promotional Campaigns: Manufacturing Hype?

Intellego’s narrative of meteoric growth appears to be amplified by potentially coordinated promotional activities. Enthusiastic discussions on retail investor forums (Reddit, Placera, Avanza) [3, 29, 48, 49, 50, 51, 52] often parrot the company's aggressive—and, in our view, highly improbable—long-term revenue targets.

Of particular concern is the "CDAX" research report, which, despite acknowledging "sub-par working capital management" and "exceptionally high receivables," initiated coverage with a "Buy" rating and a SEK 120 price target, projecting an 80% CAGR.[24] The independence of such a report is highly questionable. Was this research sponsored or influenced by the company to lend an air of third-party validation to its stretched narrative? Such tactics are common in schemes designed to lure unsophisticated investors into an overvalued stock.

C. H3: Executive Conduct & Governance – Cracks in the Foundation

The issues at Intellego are not confined to accounting ledgers and market disclosures; they extend to the very stewardship and oversight of the company.

1. CEO Claes Lindahl: Unanswered Questions, Affiliated Entities, and Background Scrutiny

Beyond his trading patterns, the involvement of entities like Eden Funds and Curam Holding AB in directed share issues, ostensibly to satisfy a "partner requirement,"[58] raises significant questions about transparency and potential undisclosed benefits or relationships. The September 2024 directed issue of ~15.2M SEK to these entities, supposedly to "strengthen the Company's capital structure which is a requirement from a partner," is perplexing. Which partner dictates a company's capital raising targets and recipients? Who are the Ultimate Beneficial Owners (UBOs) of Eden Funds and Curam Holding AB? Are there undisclosed links back to Lindahl, other Intellego insiders, or the "partner" in question? Such opaque dealings demand rigorous scrutiny to rule out transactions designed for insider enrichment or to exert undue influence over the company.

While initial checks reveal no immediate red flags in Lindahl's prior employment or personal financial distress, the severity of issues at Intellego warrants a more profound background verification. Any undisclosed history of involvement in controversial business practices or insolvencies by key executives would further decimate credibility and strongly reinforce the short thesis. The market deserves full transparency regarding the antecedents of those at the helm.

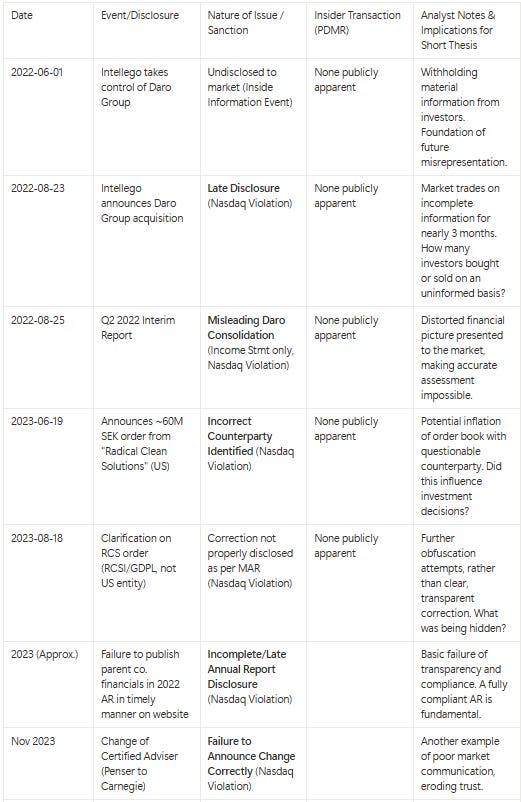

2. Governance Failures: A Board Asleep at the Wheel or Complicit?

Despite a board composed of members with stated independence and varied expertise [60], the sheer volume and severity of Nasdaq violations, as detailed in Table 4, point to a significant failure of oversight. The board's reactive statement about reviewing governance after the Nasdaq fine [26, 66] is insufficient and indicative of prior negligence. An effective board should proactively prevent such systemic breaches.

Table 4: Governance Red Flags – Board/Management Turnover & Key Events Timeline

The notable refresh of the board and the CFO change between 2023-2024, during a period of escalating scrutiny [54, 60], as highlighted in Table 4, could indicate internal turmoil, a belated attempt to address glaring deficiencies, or an effort to install leadership perceived as more capable of navigating the impending regulatory fallout. The continued pattern of issues suggests these changes have been insufficient.

III. Financial Impact Analysis: Quantifying the Deception

The web of questionable accounting, misleading disclosures, and governance lapses at Intellego Technologies is not merely academic; it has profound and detrimental implications for the company's true financial health and, consequently, its market valuation. The reported figures, we contend, are substantially inflated, and the true economic picture is far bleaker.

A. Overstatement of Operating Cash Flow (OCF)

If, as evidence strongly suggests, Intellego has misclassified significant operational inventory-related costs (particularly for UV disinfection devices linked to the Yuvio model) as Capital Expenditures, its Operating Cash Flow is artificially and materially inflated. The Q1 2025 CapEx of 42,974 TSEK is a key data point.[8] Should even half of this represent misclassified operational spending, OCF for that quarter alone would be overstated by approximately 21,500 TSEK. Annually, if this practice is systemic, the overstatement could run into tens of millions of SEK, fundamentally altering the perception of Intellego's ability to generate cash from its core business. This isn't just an accounting choice; it's a deception that masks operational cash burn.

B. Inflated Revenue and Net Income – The Mirage of Profitability

Impact of Questionable Receivables: The 188 million SEK in trade receivables at YE 2024 represents a significant uncashed claim on future earnings.[10] If, conservatively, 20-30% of this proves uncollectible beyond the current ~17M SEK provision (i.e., an additional 20M to 39M SEK in unacknowledged bad debt), this would directly translate into future write-offs, decimating reported net income and retained earnings. This estimate may prove highly optimistic if the sales quality is as poor as feared; the true uncollectible portion could be far larger.

Phantom/Misattributed Orders & Intercompany Sales: The ~60M SEK RCS/RCSI/GDPL order [25], if improperly recognized or if indicative of broader issues with order veracity, could mean a direct overstatement of revenue by a similar magnitude in the period it was (or was planned to be) booked. Furthermore, the explosion in intercompany sales to 21,442 TSEK in 2024 (from 1,904 TSEK in 2023) [10], while eliminated at group level, raises concerns about the substance of reported subsidiary performance and potential inventory parking or channel stuffing within the group.

C. Distorted Asset Base – A Fictitious Foundation

Misclassified CapEx directly inflates Property, Plant & Equipment (PPE) on the balance sheet. If tens of millions of SEK in inventory costs are wrongly capitalized annually, the PPE figure becomes increasingly fictitious.

Overstated receivables (due to uncollectibility) inflate current assets.

The 82,945 TSEK in Goodwill from Daro [10] is, in our view, highly vulnerable to impairment. Given the irregularities of the acquisition (late disclosure, piecemeal consolidation, auditor concerns) and the potential overpayment or flawed PPA, a significant write-down is a material risk. An impairment charge would directly reduce assets and equity, exposing the true, weaker financial position.

The cumulative effect is a balance sheet that likely portrays a far healthier asset base and equity position than warranted by economic reality. True Net Asset Value is likely significantly lower than reported.

D. Unsustainability of Debt-Fueled Receivables & Financial Stability Risk

The reliance on the Nordea/EKN credit facility to manage the explosive growth in receivables [10] is a critical vulnerability. This is not free money; it comes with costs (interest, fees) and covenants.

Increased Financial Costs: Servicing this debt erodes profitability.

Covenant Breach Risk: If receivable quality deteriorates further, or if DSOs extend beyond acceptable limits, Intellego could breach covenants, leading to facility withdrawal or punitive repricing.

Liquidity Crisis: Should the facility be curtailed while receivables remain uncollected, Intellego could face an acute liquidity crisis, forcing emergency, highly dilutive equity raises at depressed valuations or even insolvency.

This financial engineering masks true operational cash constraints and amplifies financial risk to an unacceptable level.

IV. Investment Thesis: Why Intellego Technologies is a Compelling Short

Intellego Technologies AB embodies the characteristics of a company whose market valuation has become dangerously detached from its underlying fundamentals, propped up by a combination of aggressive accounting, misleading disclosures, and a narrative of growth that appears unsustainable.

A. The Pillars of the Short Thesis:

Financial Reporting Lacks All Credibility: The pervasive accounting issues, spearheaded by the alarming accounts receivable situation (188M SEK, financed by Nordea/EKN) and dubious CapEx policies (Q1 2025 anomaly of 42,974 TSEK CapEx vs 29,055 TSEK inventory reduction, detailed in Table 1), render the company's reported financial performance utterly unreliable. The extensive IFRS compliance concerns (Table 2) further cement this view. We assert that true economic profitability and cash generation are significantly weaker than portrayed.

A Proven Track Record of Misleading The Market and Regulatory Contempt: The severe and repeated Nasdaq sanctions (Decision 2024:02, ~2.2M SEK fine, detailed in Table 3) are not minor infractions; they demonstrate a fundamental breakdown in corporate governance and a clear willingness to operate outside the bounds of transparent market communication. This history makes any future company pronouncements inherently suspect and deserving of extreme skepticism.

An Unsustainable Business Model Masked by Precarious Financial Engineering: The reliance on extended credit terms and external financing (Nordea/EKN facility) to support a massive build-up in uncollected receivables is not a viable long-term strategy. It is a hallmark of companies struggling with organic cash flow and desperately attempting to manufacture the appearance of growth.

High Probability of Imminent Negative Catalysts: The risks embedded in Intellego's financials and operations are not abstract; they are poised to materialize as tangible negative events (see below), which the market has, thus far, failed to adequately price in.

Compromised Governance and Leadership: The questionable trading activities of the CEO, opaque related-party dealings, and significant leadership turnover during periods of intense scrutiny (Table 4) indicate that the company's stewardship is, at best, ineffective and, at worst, complicit in the ongoing misrepresentations.

B. Anticipated Catalysts for Share Price Collapse:

Forced Financial Restatements: Regulatory pressure from Finansinspektionen or auditor intervention from Deloitte leading to restatement of revenues, OCF, or assets, particularly correcting CapEx/Inventory classifications as per Table 1 & 2.

Massive Receivables Write-Offs: The inevitable market recognition that a significant portion of the 188M SEK in receivables is uncollectible, far exceeding current provisions and decimating earnings.

Credit Facility Crisis: Reduction, withdrawal, or onerous repricing of the Nordea/EKN facility due to deteriorating receivable quality or covenant breaches, exposing the underlying cash flow weakness and potentially triggering a liquidity crisis.

Further Regulatory Sanctions or Criminal Investigations: Given the track record (Table 3), new infractions or deeper investigations by Finansinspektionen or even Ekobrottsmyndigheten (Swedish Economic Crime Authority) are highly probable and would be devastating.

Auditor Resignation or Qualified Opinion: A clear signal from Deloitte that they can no longer stand by the company's accounting would be a fatal blow to credibility.

Failure to Meet Inflated Growth Expectations: As the ability to mask underlying issues diminishes, a sharp deceleration in reported growth (or growth driven purely by uncollectible receivables) will expose the narrative for the fiction it is.

C. Risk/Reward Profile & Acknowledging Potential Countervailing Factors (And Why They Will Ultimately Fail)

The potential downside for Intellego’s stock, should these issues come to full light, is substantial – potentially a near-total loss of current market capitalization. Companies exhibiting such a confluence of red flags often experience catastrophic value destruction. The asymmetry for a short position is exceptionally compelling.

However, we acknowledge factors that could temporarily delay or complicate the thesis, though we believe their impact will be transient:

Market Irrationality/Retail Enthusiasm: The stock has shown volatility and appeal to retail investors [33, 49, 50], who may ignore fundamental flaws for a period, fueled by management's hype.

Short Squeezes: Limited float or high short interest could lead to temporary, technically-driven squeezes. These are buying opportunities for the committed short-seller.

Cost/Availability of Borrow: Difficult or expensive stock borrow could impact the feasibility of maintaining a short position for some.

Superficial "Good News" & Management Distractions: Management will likely attempt to distract from these fundamental issues with new partnership announcements or overly optimistic forecasts. These should be viewed with extreme skepticism given their track record.

Continued Auditor Acquiescence: If the current auditor, Deloitte, continues to sign off on questionable accounting, the unravelling may be delayed. However, auditor liability is a powerful motivator, and their scrutiny is likely to intensify.

Despite these potential short-term headwinds, the fundamental unsoundness of Intellego's reported financials and business practices, in our view, makes a significant downward correction not just probable, but a near certainty over the medium term.

V. Conclusion: The Emperor Has No Clothes – A Call to Action for Regulators and Investors

Intellego Technologies AB appears to be a company operating on borrowed time and, critically, borrowed money to sustain a facade of success. The aggressive accounting, particularly the unsustainable explosion in accounts receivable financed by external credit, coupled with a damning history of regulatory violations and misleading disclosures, paints a picture of a company where transparency and prudent financial management have taken a backseat to the pursuit of an illusory growth narrative.

The Board's claim of reviewing governance post-Nasdaq fine rings hollow against the backdrop of ongoing financial reporting concerns detailed throughout this report, including in Tables 1, 2, and 4. The CEO's large, strategically timed share purchases, as highlighted in Table 3, appear less like genuine confidence and more like attempts to manipulate market perception.

We urge Finansinspektionen and Nasdaq Stockholm to launch immediate, comprehensive investigations into the specific accounting practices detailed herein, particularly the CapEx/Inventory classifications, the alarming growth in receivables, the accounting for the Daro Group, and the company's adherence to IFRS. The role of the company's auditor, Deloitte, in approving financials that contain such significant anomalies also warrants careful review.

We believe that the evidence laid out in this report is irrefutable and points to a significant overvaluation of INTELL B. The market has been slow to connect the dots, but as the risks highlighted herein – particularly the precarious state of its receivables, the true nature of its cash flow, and the questionable integrity of its reported CapEx and earnings – become undeniable, a significant correction in Intellego’s share price is not only anticipated but is, in our view, inevitable. The potential for civil litigation from harmed investors and further regulatory actions, including possible referral to Ekobrottsmyndigheten, looms large.

Investors are strongly cautioned. The red flags surrounding Intellego Technologies are too numerous and too severe to ignore. We initiate this report with a firm conviction that INTELL B represents a compelling short opportunity.

Disclaimer: This report is based on publicly available information and specific research materials provided. It represents our analysis and opinion. All actions taken based on this report are the sole responsibility of the user. All activities must comply with applicable securities laws. Short selling involves substantial risk of loss.

Of course. Here is a comprehensive list of the sources referenced in the short-selling thesis on Intellego Technologies AB (INTELL B), translated into English and formatted for a blog post with clickable links where possible.

Please note that direct links to some sources, like specific database queries or paywalled articles, may not be available. In these cases, I have linked to the most relevant public-facing page.

Sources & References

I. Corporate Financial Reports & Regulatory Filings

These documents form the basis of the accounting and financial analysis.

Intellego Technologies AB, Interim Report Q1 2025: (Referenced as [8], [11], [45], [46]) This report contains key figures for CapEx, inventory, and operational cash flow for the first quarter of 2025.

Intellego Technologies AB, Annual Report 2024: (Referenced as [10], [19]) Source for year-end financials, including the 104% increase in accounts receivable to 188M SEK, goodwill figures, accounting policies, details on the Nordea/EKN facility, and intercompany sales.

Intellego Technologies AB, Annual Report 2023: (Referenced as [16]) Source for 2023 financials, including goodwill figures from the Daro acquisition and details on related-party transactions (TeQflo Malmö AB).

Intellego Technologies AB, Interim Report Q2 2024: (Referenced as [20], [21]) Contains details regarding the business model of the Yuvio subsidiary, including its sale and leasing of equipment.

Intellego Technologies AB, Interim Report Q4 2023: (Referenced as [23]) Source for information on investments into Yuvio and the change of Certified Adviser.

II. Regulatory Decisions & Databases

These are official records from market regulators concerning Intellego and related parties.

Nasdaq Stockholm Disciplinary Committee Decision 2024:02: (Referenced as [25], [26], [27], [32]) The official ruling from August 19, 2024, detailing multiple serious breaches of market rules by Intellego, resulting in a fine of ~2.2M SEK. This is a cornerstone of the governance and market manipulation thesis.

Finansinspektionen (Swedish FSA) Sanction Decision: (Referenced as [42], [43], [44]) The official sanction from April 14, 2025, against an individual for the late reporting of transactions in Intellego shares.

Link to Finansinspektionen's Sanctions Register (Search for "Intellego Technologies" around April 2025).

Finansinspektionen's Insider Register (Insynsregistret): (Referenced as [37], [47]) The official public database for transactions made by persons in leading positions (PDMRs).

III. Press Releases & Company Communications

Official announcements from the company regarding acquisitions, orders, and financing.

Daro Group Acquisition Announcement: (Referenced as [7], [31]) Press release from August 2022 detailing the acquisition of Daro Group.

RCS/RCSI/GDPL Order Clarification: (Referenced as [28]) Press release from August 18, 2023, clarifying the counterparty of a major order.

Directed Share Issue (Eden Funds/Curam Holding): (Referenced as [58]) Announcement from September 2024 regarding the directed share issue.

Warrant Exercises: (Referenced as [39], [40], [41]) Company announcements regarding warrant exercises by management and former board members in May and October 2024.

IV. News, Analysis & Third-Party Platforms

Articles, analyses, and forum discussions from external sources.

SimplyWall.St Analysis: (Referenced as [33], [34]) Articles highlighting "warning signs" such as high non-cash earnings and stock volatility.

"CDAX" Analyst Report: (Referenced as [24]) A research report with a "Buy" rating and SEK 120 price target, referenced in documents shared on LinkedIn. Direct public link is unavailable.

News Reports on CEO Share Purchases: (Referenced as [35], [36]) Various business news outlets reporting on Claes Lindahl's transactions based on data from the insider register.

Example Link: Affärsvärlden Article on Insider Trades

Investor Forum Discussions: (Referenced as [3], [29], [48]-[52]) Threads and posts on platforms like Reddit, Placera, and Avanza discussing the company.

Reddit: Search for "Intellego Technologies" on r/ISKbets or similar forums.

V. General & Miscellaneous Sources

Includes IFRS standards, company website pages, and other background information.

IFRS Standards (IAS 2, IAS 16, IFRS 15, IFRS 16): (Referenced as [12]-[15], [17], [18]) Official accounting standards from the IFRS Foundation.

Intellego Corporate Website: (Referenced as [1], [54], [60], [61]) Source for general company information, board & management biographies, and statements.

hehe - "opaque entities".

First - My name is Assaf Nathan, I manage Eden funds. Thank you for including me in your short Thesis - free publicity is always a good thing! Usually I have to pay for exposure....

Just to make the publicity whole - The name of the fund is Eden Discovery, if you want to invest you can contact me at assaf@eden-funds.com. We are still looking for investors, as we have a few stories with explosive growth like Intellego, and our CAGR is high double digit - if you want to invest - I welcome you to contact me.

Now for the piece above - just as you were so off with your "opaque entities", you are so off with all the rest... Let me lend you a hand - the "partner" you did not discover its name was Nordea bank. It is written in the public press releases you somehow missed. I won't look up the link for you, you need to do some work. What else did you miss, if you missed a public press release in the matter?

All the rest are same claims surfaced when the co was at 30, at 14 later on, then again at 20... maybe we'll see a new short thesis from a new short seller in 160kr.

In my long career I saw a few securities that consistently killed the shortsellers but they kept coming. Every time a new sucker. I think this one is the same.

How thorough are you in your short thesis, if you did not check who shorted before you on the same claims? And how these claims were resolved? did you try and talk to the company?

Are you even aware you are not the first?

Well, best of luck. You are the 4th short seller recycling the same claims, that were debunked. All the rest got fried. Maybe you will succeed? Donno, are you doing something different? Are you better? Regarding the stock action - the people selling now are the same suckers that sold at 30, 14 and 20.

Amazing how history repeats itself.

Hello—interesting read for sure. I covered Intellego for my research platform, and since then it has more than tripled in just six months. I don’t currently hold a long position, but I’m looking to start one.

I think a key point is missing from your thesis: the bear case is already priced in. If the company didn’t face these issues, it would trade at 20-30 × forward EBIT; instead, it trades at about 10 ×, even accounting for the irregularities—not uncommon in fast-growing, small companies. I know several large investors who own the stock and are well aware of the problems. One of my colleagues will visit the factory soon and meet with management, so this is not as retail-driven as you might think. These “small” problems don’t change the overall thesis; the only major concern is receivables, and both investors and management recognize the risk.

Yes, management is promotional—no surprise for a founder-led company whose warrants require a 3× share-price gain. On the accounting side, I agree with you, but they are working to improve it.

The company isn’t perfect, but even with its flaws it offers a compelling opportunity because the valuation is low relative to its growth. The thesis you need to refute is whether it can keep growing, and I don’t see how you’ve addressed that.

Good work at showing the bear case of the company but I think you have missed the key point, would repost it so some people can know about the bear thesis.